An Indian software entrepreneur's journey from a humble beginning in Trichy to ringing the bell at Nasdaq has taken the start-up ecosystem by the storm. It's the phenomenal story of Girish Mathrubootham, founder and CEO of Freshworks, the first Indian SaaS company to go public in the US. The man who started with just six employees in 2010 in Chennai now helms a company in California valued at over $13 billion. With this stellar listing, the Freshworks founder has become an enviable wealth creator, turning around 500 (70 per cent of them aged below 30) of its 4300 employees into millionaires.

Kudos to Mathrubhootam for the stunning feat! But I feel it's not a single story that we should be celebrating. Why can't Freshworks' success have "The Bannister Effect" on hordes of other start-ups? Ace athlete Roger Bannister was the first to run the mile under four minutes and inspired generations of sprinters. Freshworks' stunning listing can have a ripple effect. And resonate with the aspirational start-ups, especially in the technology domain.

The stellar listing of Freshworks Inc at Nasdaq shows what our Indian start-ups can achieve. Time to ring bells, globally.@FreshworksInc @mrgirish @stpiindia @GoogleStartups @startupindia @Nasdaq #NASDAQ #freshworks #startups #StartupSpace #STPIINDIA https://t.co/klE4gp1zps

— Priyadarshi Nanu Pany (@NanuPany) October 18, 2021

Now, it's the time for the start-ups to think bigger. The Covid pandemic has intersected disruption and innovation to expand opportunities for enterprise software companies. Today, every organization wants to achieve digital transformation apace. The International Data Corporation (IDC) research says SaaS companies have a total addressable market of $120 billion worldwide. Adoption of hybrid work models by companies across the world has jacked up demand for enterprise software products. Most of the software IPOs have witnessed a spectacular performance at Nasdaq. More of our Indian technopreneurs should now eye bigger and unlock wealth from the public listing. Back home, food delivery giant Zomato mopped up over $1 billion from the Indian capital markets in a runaway success of domestic listing. This astonishing success story can replicate on a global scale.

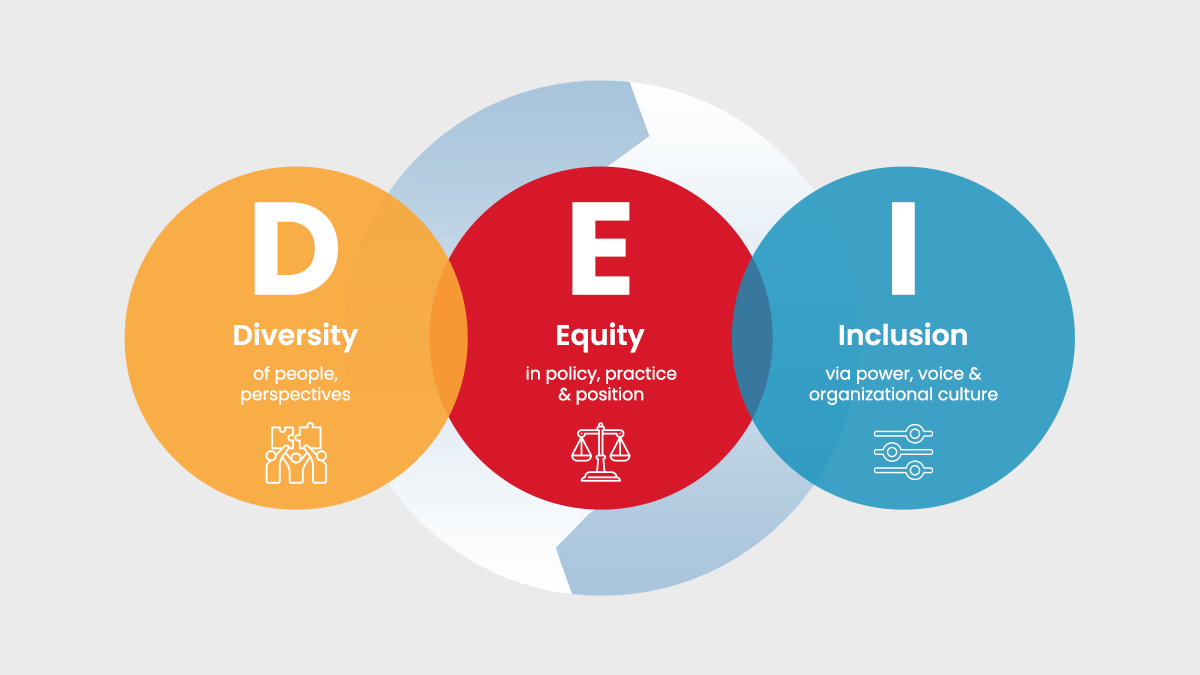

India is home to a bustling start-up ecosystem- the third largest, next only to the US and China. Over the last year, we have been adding three unicorns every month, ramping up the count to 51. Some of the EdTech start-ups are soaring in valuation, and it's an infectious trend. As a tentative entrepreneur of the 90s, I can recall how we toughed it up to succeed. The road is no less tough today; the competition is amplifying. But Indian start-up ideators have an enabling ecosystem. Thanks to pioneering initiatives like STPI's Next Generation Incubation System or the Telangana government's T Hub, start-ups have a complete assisted journey. Even before they hit the markets, they have got such a headstart. Investors are exuding more confidence in the tech start-ups. The markets, too, have the appetite. This is one of the best moments for the start-ups to stay invested in the big dream. And ring bells, globally.

We will verify and publish your comment soon.