In an era where companies face existential threats from climate crises to social inequities, corporate governance is no longer a buzzword. It’s the lifeblood of business survival. Consider this: Firms with weak governance structures are 50 per cent more likely to face financial scandals or operational collapse. As companies face mounting pressure from sustainability reporting standards like the International Sustainability Standards Board (ISSB) and the EU’s Corporate Sustainability Reporting Directive (CSRD), the spotlight is on how robust governance drives resilience, profitability, and societal good. But why does it matter so much?

The Bedrock of Resilience: Governance Meets ESG

Picture corporate governance as the roots of a tree, anchoring a business through storms. It’s the framework that ensures sound decision-making, balancing profit with purpose. Research screams it loud: companies integrating environmental, social, and governance (ESG) risks into their strategies don’t just survive, they thrive. Take IFC’s 2018 update to its Corporate Governance Methodology, it baked in ESG risk management, proving that spotting environmental or social pitfalls early boosts financial performance. Ignore this, and you are a ship without a rudder, drifting towards disaster.

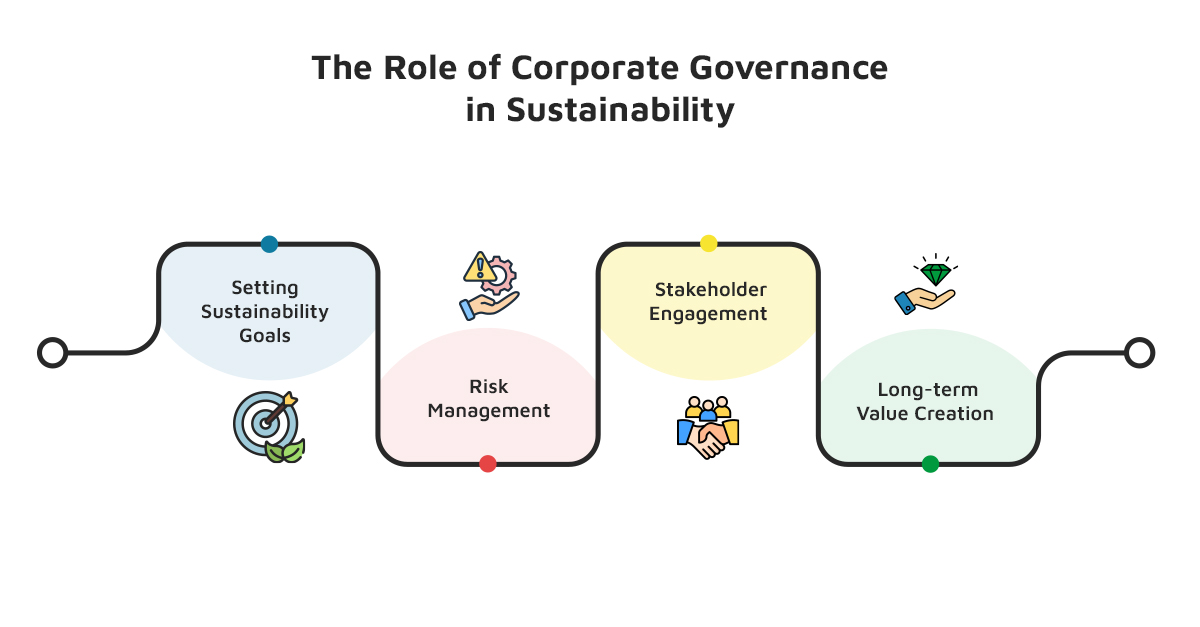

Four Ways Corporate Governance Drives Sustainability

Robust Environmental and Social (E&S) Risk Management: Corporate governance goes hand-in-hand with robust E&S risk management. Research has shown that environmental, social, and governance (ESG) risk awareness and management can improve long-term financial performance. Boards must effectively oversee E&S risks, manage stakeholder engagement, and promote transparency on sustainability performance. For instance, the International Finance Corporation's (IFC) Corporate Governance Methodology was updated in 2018 to support more robust E&S risk management.

Addressing Climate Change: Corporate governance pushes boards to address the risks and opportunities of climate change. As institutional investors press companies to eliminate greenhouse gas emissions by 2050, board members have a moral and fiduciary duty to act. IFC and others encourage boards to identify, monitor, and respond to climate-related issues, incorporating climate considerations into their business models and strategies.

Supporting Gender-Diverse Leadership: Corporate governance supports gender-diverse business leadership. Diversity in all forms is a hallmark of highly functioning boards. Companies with greater female representation on their boards are more likely to have formal climate change-related commitments and net-zero goals. For example, a recent IFC survey showed that companies with 20-60 per cent women on their boards were more likely to have climate-related commitments compared to those with less than 20 per cent female representation.

Greater Disclosure and Transparency: Good corporate governance leads to greater disclosure and transparency, allowing capital flows to shift to sustainable investment opportunities. With global development ambitions outlined in the 2030 Sustainable Development Agenda and the Paris Agreement, investors and stakeholders want to understand how a company creates long-term value and supports sustainability. This is especially critical in emerging markets where development challenges are the most severe.

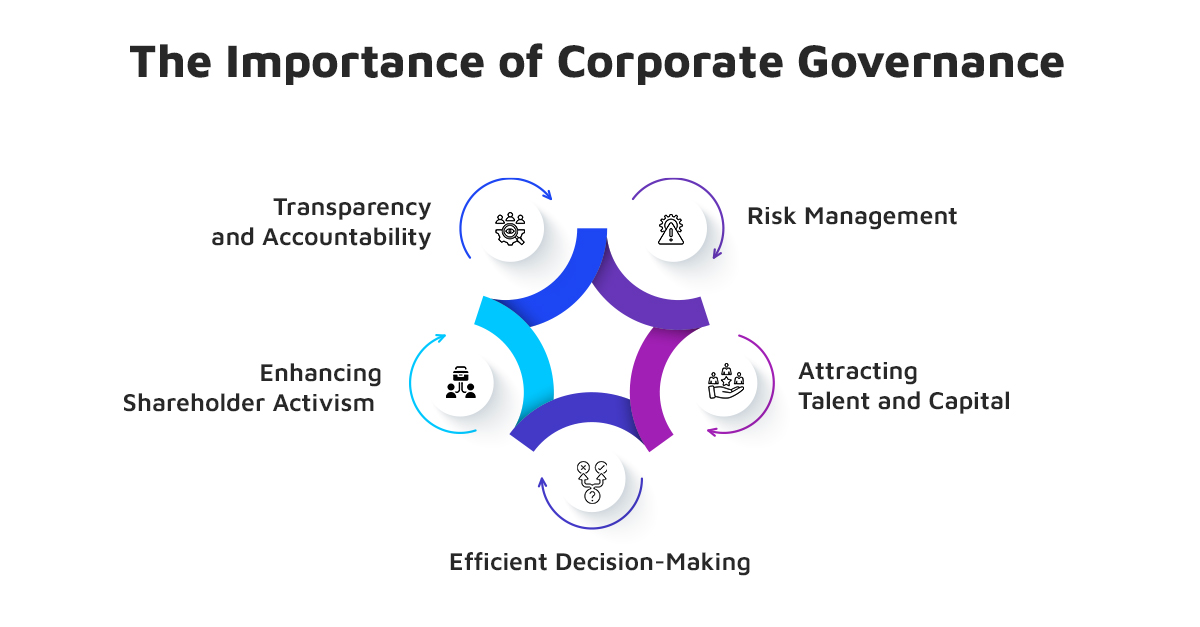

The Impact of Corporate Governance on Business Sustainability

Corporate governance matters for addressing risks, maximizing performance, climate action, inclusion, and sustainable investments. It enables ESG information, transparency, and disclosure. A sustainable future must be built with sound, solid, and strong corporate governance at its core. Consistent and profitable growth has been hard to achieve since the global financial crisis, making it critical for companies to explicitly choose growth in their mindsets, pathways, and execution capabilities. Many executives believe that making growth sustainable and inclusive requires trade-offs, forgoing revenue and profit for the sake of society and the planet. However, this is not always the case.

CSM Tech’s commitment to governance-driven sustainability

For us, governance is not a buzzword or a compliance checkbox. Rather, it is the beacon guiding every decision - whether innovating AI-driven solutions or building ethical supply chains. By embedding stakeholder collaboration and accountability into our DNA, we have cut decision-making bottlenecks and amplified trust among investors. Governance isn’t just our framework; it’s our competitive edge in delivering measurable, long-term value.

CSM has taken a leading role in the UNFCCC's Climate Change Now initiative. Moreover, as a signatory of the Amazon Climate Pledge, we are dedicated to promoting and implementing green technology for a sustainable future.

The Business Case for Corporate Governance

New analysis indicates that financially successful companies that integrate ESG priorities into their growth strategies outperform their peers provided they also outperform on the fundamentals. The message is clear: not only can you do well while doing good - you can do better. For instance, a study of 2,269 public companies showed that companies that achieve better growth and profitability than their peers while improving sustainability and ESG outgrow their peers and exceed them in shareholder returns.

Why It Counts: The Big Picture

Corporate governance counts because it’s the glue for the triple bottom line: people, planet, profit. It’s about outlasting crises, seizing opportunities, and proving you can do well by doing good. In a world of climate chaos and stakeholder scrutiny, businesses without it are dinosaurs waiting to fossilize. Strong governance isn’t just smart - it’s survival.

We will verify and publish your comment soon.