The Covid pandemic proved to be the first major accelerator. For firms in the Banking, Financial Services & Insurance (BFSI) sector to embrace digital transformation at speed and scale. Per a report by Deloitte, the pandemic impelled the BFSI companies to digitize their operations apace, resulting in soaring digital adoption among customers.

Today, digital transformation is a strategic priority for scores of BFSI firms. In the US, digital transformation in BFSI has been driven by factors such as changing customer expectations, the rise of new technologies, and increasing competition from Fintech startups. It won’t be far-fetched to say that emerging tech is the next big accelerator for BFSI companies speeding on the digital transformation highway. The trend is validated by an upsurge in investments in cutting-edge digital technologies.

For example, the emergence of conversational Artificial Intelligence (AI) and Natural Language Processing (NLP), through chat and voice bots, has given banks the power to replicate the in-person branch experience on a larger scale, with the added ability to communicate in the customer's preferred language.

Moreover, modern technologies like AI, Machine Learning (ML), cloud computing, and DevOps have taken the lead in automating fraud detection and anti-money laundering, while also delivering more refined and personalized experiences to customers.

Dissecting the Market

According to MarketsandMarkets, the global digital banking platform market is expected to grow by 11.3 per cent CAGR between 2021 and 2026. In addition, Statista predicts that 2.5 billion people will use online banking by 2024. It's no secret that digital transformation is taking over many industries, but it's more prominent in customer-centric businesses where faster processes are a necessity, as well as a growing need for on-the-go services.

The Use Cases You Can’t Ignore

The implementation of digital transformation in BFSI has evolved over the years to enhance organizational business insights, lower operational costs, and accelerate workflows. The spike in the number of use cases attests to the success story. Here are select use cases that are pointers to the changing landscape of the BFSI sector.

1. AI-Powered Bots For Frictionless Customer Service

BFSI companies, especially banks are leveraging the power of AI-powered bots to deliver frictionless services on multiple digital touchpoints. The surging popularity of Virtual Assistants and super apps for the whole gamut of banking and financial needs has helped in better and easier financial planning and management. Today, bots are serving an array of customers simultaneously, divesting humans of iterative tasks. Also, bots can handle transfers, payments, credit card activation, password resets, blocking stolen or lost cards, updating beneficiaries, and reminding customers of EMI payments. To illustrate, the US Bank launched a conversational AI-enabled Smart Voice Assistant for its Android and iOS apps. In response to a customer's tap on the microphone button in the app, the AI voice bot acts as a digital bank teller. The service provides customers with access to their bills and spending histories, as well as the ability to make transfers and manage their credit cards.

2. Hyper-Personalization of Banking and Financial Services

AI and ML are helping BFSI firms develop innovative business models that promote financial inclusion and hyper-personalize customer journeys. With bots that are powered by sentiment analysis and support for multiple languages and dialects, banks can offer customers convenient, personalized service. Moreover, advanced AI-driven smart analytics and Big Data analytics can analyze customer needs, behaviour, and profiles and suggest products and services that fit them.

3. AI-Driven Cognitive Document Processing

Every day, BFSIs process millions of simple and complicated documents, like KYC documents, identity proofs, contracts, legal and trust documents, and financial reports. A cognitive document processing solution uses advanced ML and AI technologies to automate the process of organizing, inputting, and evaluating documents in a quick, secure, and cost-effective manner. Consider Microsoft's Azure Forms Recognizer. The Azure Forms Recognizer can read structured and unstructured documents, including machine print and cursive writing. All you have to do is customize the tool to understand your documents and extract tables, structures, and key-value pairs. How does it work? The first step is to scan and classify documents. Then comes data extraction and validation. Lastly, information gets moved into downstream processes like underwriting/credit, loan origination, etc.

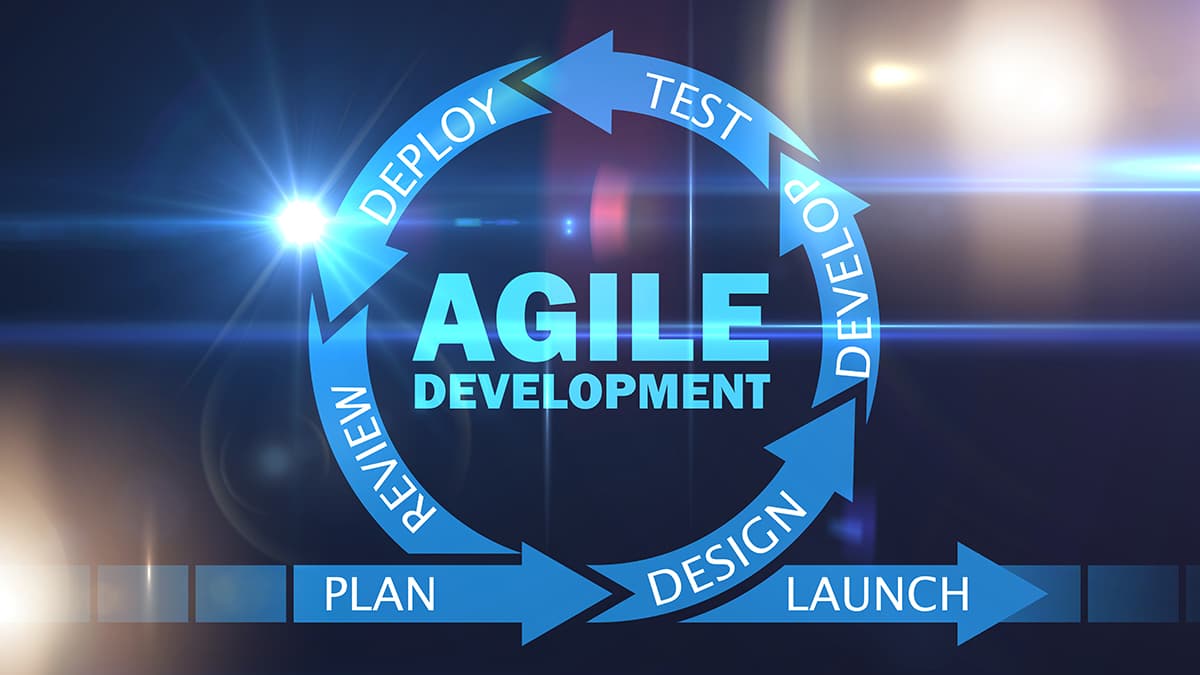

4. Agility in Banking Operations with Legacy System Modernization

In the BFSI industry, new players, particularly fintech and neo banks, have reshaped the industry with personalized digital banking services at lower costs. For traditional banks to stay competitive, innovate, and survive, they need to modernize their legacy operations by:

- Adopting highly agile and future-proof technologies like low-code app development platforms

- Undergoing legacy system modernization by migrating to cloud computing

- Implementing AIOps to optimize cloud consumption and reduce costs

5. Security and Fraud Detection

Banks and other financial institutions use AI/ML to detect anomalous activity. With a continuous stream of incoming data, the model knows what normalized activity levels are. In the event of a deviation from expected trends, it can alert the human agent. "Behavior profiling" is another method banks and other financial institutions use. Behaviour profiling studies customers, accounts, merchants, and other entities to understand how, where, and what type of transactions they do. Anomalies can be detected with this information. It's important to diagnose suspected fraudulent activity in real-time, but what's even more important is scoring a transaction based on its risk level. Predictive analytics does just that. In addition, prescriptive analytics suggests what to do if fraud is detected.

What’s Next on the Digital Frontier?

Digital transformation is unquestionably a must for businesses, especially those in BFSI. Digital technologies, platforms, and solutions help the industry speed up operations, improve operational efficiency, and enhance customer experience (CX). Additionally, digital transformation of the BFSI industry removes flaws in applications and software, improves the speed of banking applications, and ensures the app's effective load-handling capability by improving usability.

Want to start a project?

Get your Free ConsultationOur Recent Blog Posts

© 2025 CSM Tech Americas All Rights Reserved